Credit cards allow people to make purchases based on the promise that they will repay the amount back at a later date with interest. Having good credit and great credit repayment history can help financial institutions decide whether or not to approve a loan for a big purchase like a car or home mortgage.

Are You Ready To Work Your Ass Off to Earn Your Lifestyle?

Are you tired of the daily grind? With a laptop and an internet connection I built a small website to generate income, and my life completely changed. Let me show you exactly how I’ve been doing it for more than 13 years.

The credit card niche can be a highly profitable and interesting area for affiliate marketers to focus on. With the increasing use of credit cards for both personal and business purposes, there is a growing need for information and resources related to credit cards and credit management. This presents a unique opportunity for affiliate marketers to promote products and services that cater to the credit card industry.

One of the biggest advantages of the credit card niche is that it is highly relevant to a wide range of people. Almost everyone has experience with credit cards, whether they use them regularly or only occasionally. This means that affiliate marketers can easily connect with their audience and provide valuable information and resources that are relevant to their lives.

In addition to being relatable, the credit card niche is also incredibly diverse. There are countless products and services that cater to different credit card needs, such as credit card comparison tools, credit card reviews, credit card rewards programs, and even personalized credit management services. This allows affiliate marketers to choose the products and services that align with their own interests and expertise, and to create a unique and engaging brand.

For the business owner, the credit card niche can be an exciting and rewarding area to focus on. Not only can it be financially lucrative, but it also allows for creativity and personal growth. As an affiliate marketer in the credit card niche, you can help people to improve their credit scores and manage their finances more effectively. This can be incredibly satisfying, and can also provide opportunities to connect with like-minded individuals and build a supportive community.

As an affiliate marketer promoting credit card products and services, you can help consumers in a number of ways. For example, you can provide valuable information and resources that can help them to make informed decisions about the credit cards they use. This could include tips on how to compare credit cards, how to maximize credit card rewards, and how to avoid credit card fees and interest charges.

Additionally, as an affiliate marketer, you can help consumers to find the right credit card products and services for their specific needs. For instance, if you are promoting a credit card comparison tool, you can provide information on how the tool works, the features it offers, and the types of credit cards it compares. This can help consumers to make an informed decision about whether or not the tool is right for them.

Overall, the credit card niche is a highly profitable and interesting area for affiliate marketers to focus on. Not only can it provide financial rewards, but it also offers the opportunity to help people improve their financial health and make the most of their credit cards. As an affiliate marketer in the credit card niche, you can provide valuable information and resources that can help consumers to make smart and informed decisions about their credit cards.

There is also a growing trend of signing up for credit cards based on their rewards programs and paying them off before any interest is due. Another trend on the other end of the credit card spectrum is credit score monitoring and credit repair services to help improve your credit scores.

Credit card affiliate programs typically pay very well in comparison to other niches and industries, so they are very popular to promote! Here are 10 great credit card affiliate programs:

Credit Card Affiliate Programs

- Bankrate Credit Card Network

- Credit.com

- CommissionSoup

- Capital Bank

- Credit Assistance Network

- Experian

- Credit Repair

- FlexOffers

- TransUnion

- Credit Karma

Bankrate Credit Card Network

- URL: Bankrate Credit Card Network Affiliate Program

- Commission: Varies

- Cookie: Varies

The Bankrate Credit Card Network is a credit card affiliate marketing program leader. Their team is made up of credit card performance marketing experts. They provide the best credit card offers from top issuers like American Express, Capital One, Discover, Chase, and Citi.

Their affiliate program is managed in-house. Bankrate Credit Card Network provides their affiliates with award-winning editorial content, user-friendly tools, co-brand solutions, and data feed. They work with their affiliates to help them meet their business goals.

Affiliates have access to the leading credit card offers and some of the industry’s top monthly payouts.

Why Should You Promote Bankrate Credit Card Network: Credit card affiliate marketing platform leader, offers for top credit card companies, personalized affiliate help

Credit.com

- URL: Credit.com Affiliate Program

- Commission: Varies

- Cookie: Varies

Credit.com was founded by credit experts and consumer advocates to help people make smarter financial decisions. They provide free education, tools, and unbiased comparisons of financial services and products. Their goal is to be the go-to source for expert information on all things personal finance including credit scores, credit cards, and credit reporting.

They offer high conversion rates and payouts. Affiliates have access to a great selection of exclusive offers, custom branding, and creatives. Credit.com offers live online reporting and help from their experienced affiliate support team to help you get started and answer any questions.

Credit.com works closely with their advertisers to provide the best converting products and great payouts for their affiliates.

Why Should You Promote Credit.com: Best credit product and services, high converting products, exclusive offers

Note: This affiliate program seems to be only available to current affiliates at this time, but please contact them to make sure. If your website has relevant traffic, you might be able to still get an account there.

CommissionSoup

- URL: CommissionSoup Affiliate Program

- Commission: Varies

- Cookie: Varies

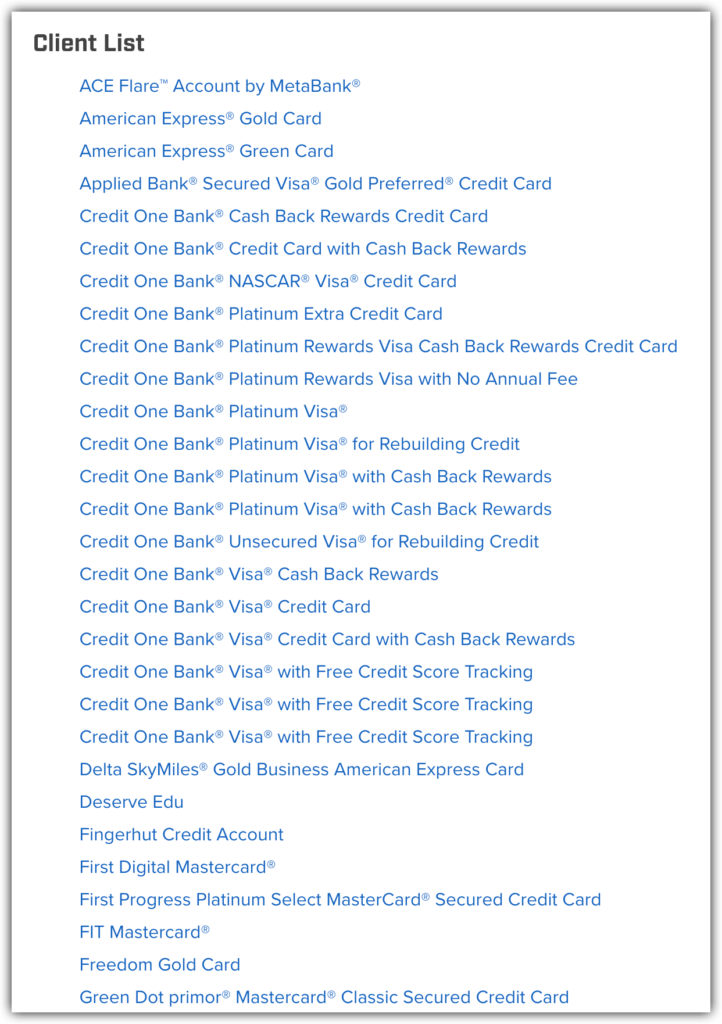

CommissionSoup is a performance-based affiliate marketing network. They have some of the best credit cards offers from well-known and respected banks. Their great selection of credit cards means consumers and business owners can find the perfect card to fit their needs.

They have over 18 years of financial marketing experience. CommissionSoup is committed to helping their affiliates maximize their revenue opportunities. Affiliates have access to their proprietary technology and optimized marketing materials to help them promote.

Why Should You Promote CommissionSoup: Performance-based affiliate network, top credit card offers, proprietary affiliate technology. I also like that you have a HUGE selection of credit cards to promote, rather than just one company!

Their affiliate account representatives will discuss your marketing options and best programs for your target market to help maximize your conversion rates.

Capital Bank

- URL: Capital Bank Affiliate Program

- Commission: $25 per funded account

- Cookie: 30 days

Capital Bank offers a consumer-friendly secured credit card called OpenSky. The OpenSky Secured Visa Credit Card helps build your credit with no credit check required to get started. Customers choose their credit limit and secure it by making a one-time refundable deposit to help improve their credit score.

Affiliates can sign up for the Capital Bank affiliate program at Commission Soup (listed above), or you can join as a Sovrn affiliate. You’ll have less control with your Sovrn links, but it’s an alternative option for you.

Why Should You Promote Capital Bank: Secured credit card, helps improve credit score, lots of helpful information and guides

Cardholders receive benefits like travel/car rental insurance, zero liability for fraud, and can use their secure credit card anywhere Visa is accepted.

Credit Assistance Network

- URL: Credit Assistance Network Affiliate Program

- Commission: $95 per sale, $1.25 per lead

- Cookie: 365 days

Credit Assistance Network is an industry leader in credit repair with an A+ Better Business Bureau ranking. They help consumers resolve complicated credit problems. They can help with everything from building credit, late payments, bankruptcy, incorrect personal information, excessive inquiries, debt management, and much more.

They prefer to partner with affiliates that have websites about credit, finance, debt, or self-help. Credit Assistance Network uses ShareASale to manage their affiliate program. Affiliates have access to a great selection of creatives, coupons, special offers, and tracking tools.

Why Should You Promote Credit Assistance Network: Credit repair industry leader, helps build a credit score, lots of marketing materials

Their exceptional affiliate management team is available to help affiliates succeed.

Experian

- URL: Experian Affiliate Program

- Commission: $0-100

- Cookie: 45 days

Experian is the #1 provider of consumer credit scores, credit reports, identity theft protection, and credit monitoring online. They have delivered over 20 million credit reports and provide more than 3.1 million members with credit monitoring products.

They use Commission Junction to manage their affiliate program. Affiliates can sign up by searching for them in the advertiser’s section on cj.com. Experian provides their affiliates with all the marketing materials and tools they need to get started.

Why Should You Promote Experian: #1 online consumer credit score provider, well known trusted provider, great commission rates

Affiliates can earn great commissions with Experian. Be sure to check out their terms & conditions to learn more about their commission rates for each product.

Credit Repair

- URL: Credit Repair Affiliate Program

- Commission: $70

- Cookie: 90 days

CreditRepair is the top provider of credit repair services in the US. They have developed and refined their process over many years and helped thousands of customers. Their credit repair experts will work with you to help you meet your credit goals.

Their affiliate program has been running for the past 10 years. CreditRepair uses Commission Junction to provide affiliates with all the resources and tools they need. Not only do affiliates earn great commissions, but they also get to help people achieve financial freedom.

Why Should You Promote CreditRepair: Leading credit repair service, help people improve their credit scores, high commission payouts

Be sure to check their terms and conditions to make sure they do business in the states you’d like to market.

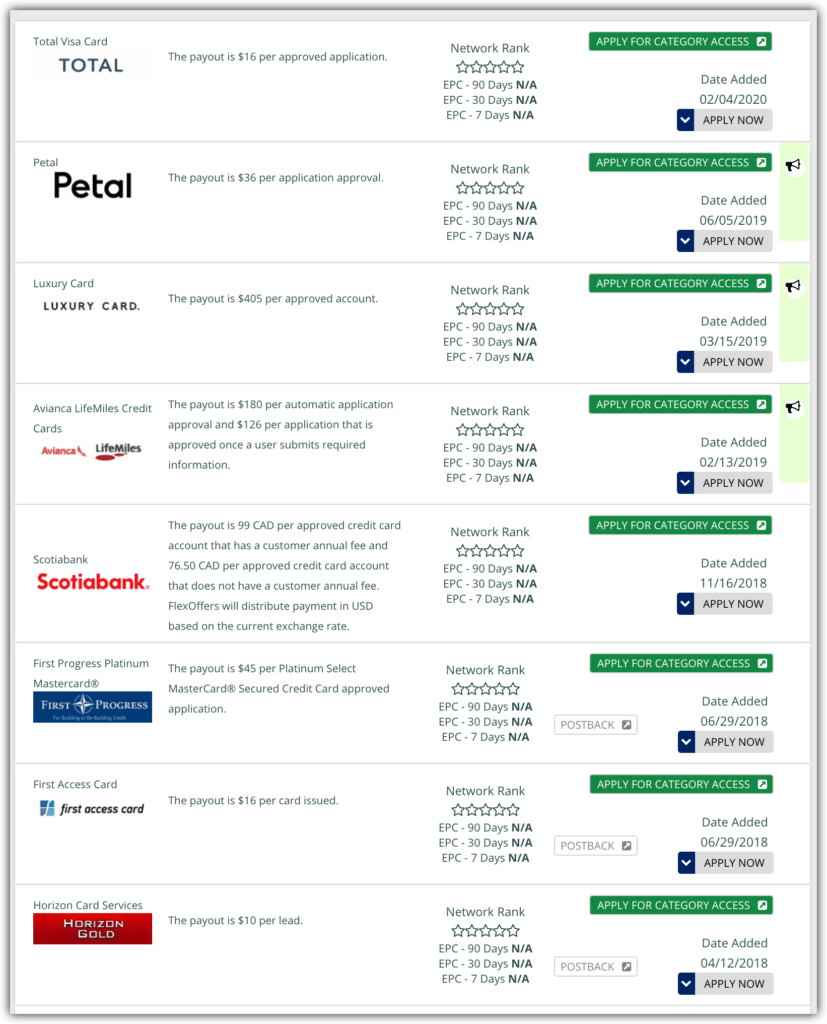

FlexOffers

- URL: FlexOffers Affiliate Program

- Commission: Varies

- Cookie: Varies

FlexOffers is a top affiliate marketing network platform with industry-leading features. They work with the top networks, advertisers, and agencies to add more than 50 new advertiser programs each day. They currently have two credit card affiliate programs, Amalgamated Bank of Chicago BankCard and the Barclaycard.

Affiliates can boost their profits by promoting their lucrative programs. FlexOffers provides affiliates with banner ads, text links, and unique promotional copy. Affiliates also have access to reports, data feeds, tracking tools, and affiliate support.

Why Should You Promote FlexOffers: Award-winning affiliate marketing, over 50 new programs added each day, industry-leading affiliate tools

Affiliates can promote all types of financial programs all from the same affiliate network.

TransUnion

- URL: TransUnion Affiliate Program

- Commission: $20 per $1 7-day trial, $45 per paid product

- Cookie: 45 days

TransUnion is a credit reporting agency that helps their members monitor and protect their credit. Available member benefits include unlimited score access, instant credit alerts, and Credit Lock Plus to shield your TransUnion and Equifax reports. Their mission is to enable consumers to understand and manage their personal information.

Affiliates can learn more about the TransUnion affiliate program by searching for them in the advertiser’s section on Commission Junction. Their program is open to US-based publishers. They provide affiliates with access to a great selection of marketing materials and tracking tools to start promoting right away.

Why Should You Promote TransUnion: Top credit reporting agency, great membership features, competitive commission rates

Affiliates earn $20 per $1 7-day trial and $45 for almost every other product except for TransUnion Credit Monitoring which ranges from $30-65 per plan.

Credit Karma

- URL: Credit Karma Affiliate Program

- Commission: $0.25 per sign up

- Cookie: 30 days

Credit Karma offers free credit scores, reports, and insights with no hidden fees, subscriptions, or upsells. Their services are 100% free with no credit card required. They help provide people with the information they need to take control of their credit. They also offer credit monitoring and personalized recommendations on how to use your credit more wisely

Affiliates can sign up by searching for Credit Karma at FlexOffers. Credit Karma affiliates get the tools, educational articles, and opportunities they need to aid them in their financial progress. Customers can check their scores anytime, anywhere through Credit Karma’s free platform.

Why Should You Promote Credit Karma: Free to use, credit score monitoring, great add on affiliate program

Credit Karma is a great add on affiliate program to promote with other offers. All your viewers have to do is sign up and pull their free credit score for you for free to receive a commission.

2020 Update

Here are a couple more credit card affiliate programs I found. This is pretty much an exhaustive list now.

- Card Ratings: Credit card lists and reviews

- American Express Payment Gateway: For enrolling small businesses in the Amex payment gateway program

- Bank Affiliates: A bunch of different credit card affiliate programs

- VIABUY: Prepaid debit Mastercard

- Multicard: Online credit card payment processor

- Credit Card Broker: Credit card comparison engine

Credit Card Affiliate Website Ideas

Now that you’ve discovered 10 great credit card affiliate programs, it’s time to pick a niche to target. My advice is to think about who is using your credit card. The goals of establishing credit or collecting points may be the same, but your target audience and how relate to them may differ.

Credit Cards for Students

This website could be geared towards helping college students to navigate the world of credit cards and credit management. It could feature a range of credit card products and services specifically designed for students, such as student credit cards with low interest rates and no annual fees, credit card comparison tools that prioritize student-friendly features, and even personalized credit coaching for students looking to build a strong credit history. The website could also include educational content on topics such as how to choose the right student credit card, how to manage credit card debt as a student, and how to build a strong credit score.

Credit Cards for Small Businesses

This website would be focused on helping small business owners find the right credit card products and services for their businesses. It would offer a range of credit card products and services specifically designed for small businesses, such as business credit cards with generous rewards programs and low interest rates, credit card comparison tools that prioritize business-friendly features, and even personalized credit coaching for small business owners looking to improve their credit scores.

Credit Cards for Travelers

This website could be aimed at helping frequent travelers to find the best credit card products and services for their travel needs. It could feature a range of credit card products and services specifically designed for travelers, such as travel rewards credit cards with generous rewards programs, credit card comparison tools that prioritize travel-friendly features.

Using a credit card while traveling is popular for a number of reasons. For one, a credit card can be a convenient and secure way to make purchases while traveling, both domestically and internationally. It can also provide valuable protections, such as fraud protection and rental car insurance. Additionally, many credit cards offer special benefits and rewards programs for travelers, such as discounted flights and hotel rooms, cash back on travel-related purchases, and travel assistance services. Overall, using a credit card while traveling can provide convenience, security, and valuable perks, making it an attractive option for many travelers.

Credit Cards for Bad Credit

This website could be focused on helping individuals with bad credit to find credit card products and services that cater to their specific needs. It could feature a range of credit card products and services specifically designed for people with bad credit, such as secured credit cards with low deposit requirements, credit card comparison tools that prioritize credit-building features, and even personalized credit coaching for individuals looking to improve their credit scores. The website could also include educational content on topics such as how to choose the right secured credit card, how to build a strong credit history, and how to avoid common mistakes that can hurt your credit score.

Credit Cards for Military Personnel

This website could be aimed at helping military personnel and their families to find the best credit card products and services for their unique needs. It could feature a range of credit card products and services specifically designed for military personnel and their families, such as military credit cards with generous rewards programs and low interest rates, credit card comparison tools that prioritize military-friendly features, and even personalized credit coaching for military personnel looking to improve their credit scores.

Boost Your Affiliate Earnings

These 10 affiliate programs are just the beginning of what's possible. There are hundreds of ways to earn affiliate commissions with your website, including product reviews, top 10 lists, how-to guides, and more

But what about traffic and conversions? How do you make sure your affiliate links get clicked?

I used the affiliate training here to turn my brand new website into a six-figure income generator in less than two years. Build a business, not just a pocket-money side project!

Nathaniell

What's up ladies and dudes! Great to finally meet you, and I hope you enjoyed this post. My name is Nathaniell and I'm the owner of One More Cup of Coffee. I started my first online business in 2010 promoting computer software and now I help newbies start their own businesses. Sign up for my #1 recommended training course and learn how to start your business for FREE!

Top 13 CBD Affiliate Programs To Cash In On This Growing Trend

Top 13 CBD Affiliate Programs To Cash In On This Growing Trend

Susie Henderson

You may want to check out iCommissions. Another credit card offer provider to affiliates who has been around for decades. Focusing mostly in the subprime areas, offers are solid with market recognition. Email me for more information.

Cory

Does Credit Karma still have an affiliate program?

Nathaniell

Yes, but you have to apply through Viglink. Here’s the current info

aaron

do you know any that are easy to get into? I have 100 visitors a day for credit card traffic on my niche site. But none of these approve me. They want you to be like a massive site like nerdwallet

Nathaniell

100 visits a day is OK for many affiliate programs, but credit card affiliate are going to be super strict because they only want the highest quality promoters. They’d rather have two people with a million visits a day than 2,000 people with 100 visits a day.

Most of the time I’d say that any site can be accepted to affiliate programs, but credit cards seem to be the exception.