Trading an asset is an inherently risky undertaking. Yet some asset classes are older, rely on licensed traders and on complex strategies that minimize volatility. This is not the case with markets having more lax regulations. Pump and dump, originally used to describe penny stocks (very cheap and low-volume traded stocks), it’s now become part and parcel in the world of crypto coins.

Are You Ready To Work Your Ass Off to Earn Your Lifestyle?

Are you tired of the daily grind? With a laptop and an internet connection I built a small website to generate income, and my life completely changed. Let me show you exactly how I’ve been doing it for more than 13 years.

“Lovingly” referred to as P&D, it seemsto be extremely well-suited to how crypto trading works.

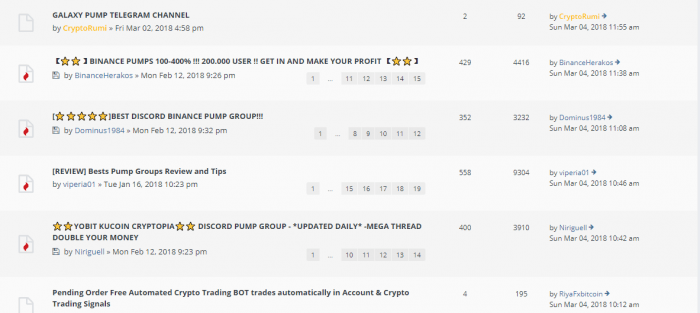

There is no unified source of pump-and-dump groups, and there are various ways to approach this type of trading, if one chooses to take the risk. Just make sure you don’t get caught with a case of FOMO and are left holding the bag after a coin price tanks.

The Origins of P&D Schemes

There are several factors that make P&D schemes viable. The first one is the niche nature of Bitcoin, which for years was considered a joke by not just the finance world, but by almost everyone. This led to the adoption by just a few people, causing a handful of users accumulated a lot of Bitcoin wealth.

Afterwards, Bitcoin appreciated, so the acquisition of more Bitcoin became the name of the game. In the meantime, many new altcoins came along, appearing almost every day. Very few of them had any real value, and only a handful traded directly against fiat currencies.

This meant that Bitcoin holders could affect the low-volume market for a coin with just a handful of their stash, and in the end, accumulate more Bitcoin by trading. In other words, Bitcoin holders were able to manipulate the markets with their extreme wealth.

Since Bitcoin was not considered money, this type of trading is not (up until recently) regulated. There haven’t been any prosecutions or jail time for pump and dump proponents, if cryptocurrencies ever get regulated, P&D will definitely be one of the first things they attempt to manage.

How P&D Schemes Works

Simply, these schemes work when a coordinated effort is made to bid up the price of a chosen asset. This may happen fast, even within hours or minutes, and even use automated trading.

The additional work of riling up investors is interesting. Usually, the agreement is that a pump event would be announced, so a small circle of investors could buy and sell a specific coin. However, the misleading part is that no one knows if the information is accurate. Sometimes, in a type of “meta scam” the scam is that they trick someone into thinking he/she has been selected to become a part of the inner circle of a P&D scheme.

In the end, it may turn out that there was nothing close to the truth, and in fact the P&D was well underway, only inviting buyers at the last moment. While early arrivals can make a profitable trade, others may be invited just to supply their presence as “bag holders”, being left with rapidly depreciating altcoins.

The Public Profile Of P&D Schemes

Sometimes, pumps are greeted as a positive thing. Some coins are chosen for trading just because there are enough big holders, or “whales”, to provide liquidity, and it is possible to use the general hype to sell profitably.

However, outright invitations to participate in closed groups or channels are viewed as a great violation in the crypto space. Such comments often appear in Twitter comment threads and are torn down as gauche.

Some schemes scam naive investors by also posting a tentative price toward which a coin could move. But then, insiders don’t wait for the promised price, instead place large sell orders and tank the price within minutes. Naive buyers are left holding the bags, having bought at the peak with expectations of larger increase. In fact, pump organizers may start selling their accumulated stash very early in the game, even at lower prices, realizing at least some profits.

“There’s a lot of market manipulation out there,” said @VasjaVeber, alluding to the ‘pump and dump’ schemes in which traders conspire to artificially inflate the price of useless coins before ‘dumping’ them for profit – something highly illegal in traditional.'' @Viberate_com

— Madinai Yahyo (@MadinaiYahyo) February 20, 2018

Fake Signals and Copycat Pumps

Some groups depend on “signals” for a coin, giving an air of legitimacy to an asset. But in fact, all the volume and demand may be faked by a large holder.

Other P&D schemes have elaborate referral programs, which add layers of traders that get the name of the pumped coin a few seconds later than the more inner layers. Depending on luck, skill or pump size, this may be profitable – or a catastrophe.

https://twitter.com/CryptoSubbu/status/969179659643604992

Some believe any Tweet can be seen as the trigger for a P&D, even without coordination. Influential accounts that mention a coin can achieve that effect. Unfortunately, a P&D can only be assessed in hindsight, yet accusations of shilling or pumping never stop.

Why You Should Not Participate In Any “Pumps”

Trading by trusting a P&D group means buying a coin with no previous research. It also may mean exposure to obscure exchanges and digital assets that have no other merits.

But the chief reason to avoid those groups is that the P&D group may have many layers, like an onion. You have no way of knowing how far you are from the center, and whether the notification you get is not coming fatally late, as the organizers have already realized profits. The time window of profitability may be minutes, even seconds before the price crashes, and let’s face it, you’re not that smart (neither am I).

Also, it is best to avoid coins that are spiking, since there is no telling where the pump could lead. Some coins never move for months, only to appreciate quickly. Usually, the peak levels do not last for long. (There is one way that pumps are sometimes beneficial – they may serve to bring a coin to more attention, and even after the crash, the asset trades higher than before.)

The increased amount of pump and dump schemes in the cryptocurrency market has prompted the Commodities Futures Trading Commission to issue a Consumer Protection Advisory statement. pic.twitter.com/kbCp1Atzsl

— Vrije Vogel (@SHTTKN) February 24, 2018

So it is best to buy coins after doing adequate research, ensure there is access to high-quality, liquid exchanges, and placing a reasonable personal target for taking profits, much like traditional stock trading. It is best to know the trading profile of a coin and notice anomalous activity immediately. If invited to a P&D announcement, it is best not to trade on that tip, as it is highly likely you would be among the bag holders, the outer layer of the onion, when the major profit taking has already happened.

Luckily, crypto pump & dump schemes, for now, are only spreading among the community, and require technical knowledge to participate. Many times, when people new to crypto being targeted, seasoned skeptics are able to intervene and offer sound advice. If you are uncertain about a coin, it is best to use one’s own knowledge as far as possible, and avoid trying to get guaranteed returns in a highly risky, volatile pump event.

Nathaniell

What's up ladies and dudes! Great to finally meet you, and I hope you enjoyed this post. My name is Nathaniell and I'm the owner of One More Cup of Coffee. I started my first online business in 2010 promoting computer software and now I help newbies start their own businesses. Sign up for my #1 recommended training course and learn how to start your business for FREE!

Sound Technician Salary and Career Options: Good Jobs That Don’t Require a Degree

Sound Technician Salary and Career Options: Good Jobs That Don’t Require a Degree

Leave a Reply