The concept of NFTs have been around for a few years, but it was 2021 where things really blew up and they entered into the mainstream consciousness. Part of the reason for the hype is the massive amount of money some NFTs are selling for… and how stupid it all looks to outsiders.

Are You Ready To Work Your Ass Off to Earn Your Lifestyle?

Are you tired of the daily grind? With a laptop and an internet connection I built a small website to generate income, and my life completely changed. Let me show you exactly how I’ve been doing it for more than 13 years.

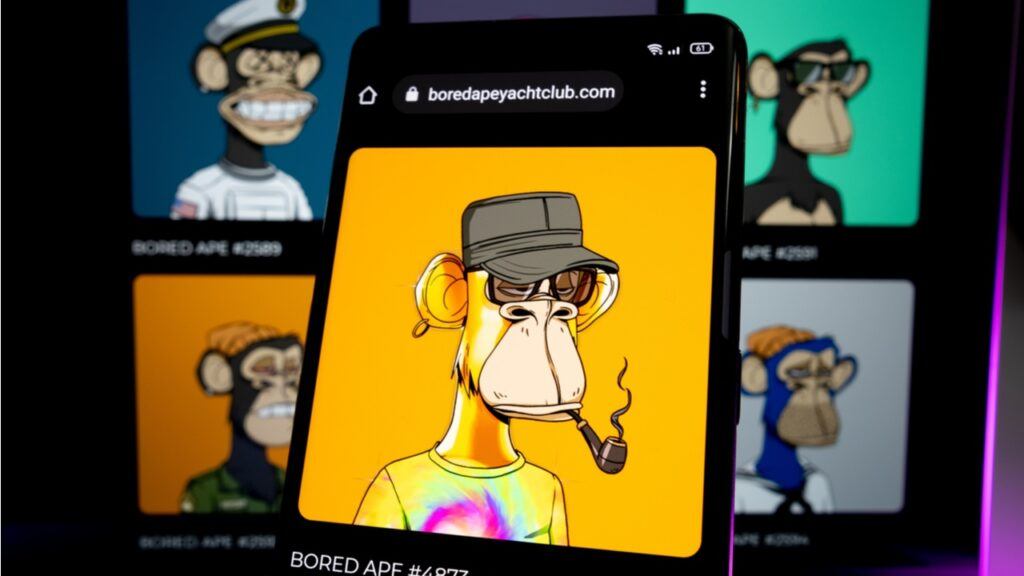

What do you mean a picture of a monkey smoking a joint just sold for $2 million dollars?

When money moves this fast, it generates a lot attention, and now a lot of people want to make money with NFTs. The trouble is, the space is so new, that there’s not a ton of easy-to-understand information about what NFTs are and how to make money from them.

This article is going to be a broad overview of the market, and a jumping-off point if you want to get into the industry. NFTs are not my thing, and I’ll explain why throughout the article. In short, some people make serious money with NFTs, but most people do not.

What Are NFTs?

What People Think NFTs Are

When most people think of NFTs, they think of digital art. If you look up “NFT”, most of what you’ll find is pictures of weird looking animals like fat penguins, cute aliens, and bored apes, though you may also see some pixel art and squiggly colored lines.

Beauty is in the eye of the beholder, right?

The “NFTs are digital art” narrative really took off, and a lot of buyers of NFTs look at their purchase as a kind of investment, either trade, or to hold long term. Famous art is worth a lot, right, so famous digital art must be worth a lot too!

In reality, what NFTs actually are is a little more nuanced than that.

What NFTs Actually Are

More specifically, NFTs are a hash of a URL, and you can prove ownership of that specific hash through your crypto wallet. What that means is that NFTs are not actually digital art. NFTs are better understood as a digital receipt, or a digital certificate of authenticity.

NFTs to do not give you ownership of a piece of art. They do not prevent others from viewing, distributing, or modifying your art. They do not give ownership of the image itself, and do not even give you copyright over the image.

That means you can’t prevent others from viewing it. You can’t prevent the art creator from minting more copies and selling more. You can’t create swag or gear with the image and profit from sales.

What you own exclusively limited to the hash, which is basically a long string of numbers – kind of like a code – which denotes ownership specific mint of the image.

Are NFTs The Same As Digital Art Or Digital Trading Cards?

Lots of people draw comparisons to baseball cards or Pokémon cards. You may own #26 of 100 copies of an exclusive card, but there are 100 other copies out there. The company producing the cards can make more of them if they feel like it. Ownership of the card doesn’t mean you own the character or ball player image. All you own is the single card.

One advantage of NFTs over traditional trading cards is that there’s a global marketplace, so your assets are much more liquid. They’re easier to sell! Also, it’s easy to verify the authenticity of an NFT directly online, instead of going to specialized dealer, which could still be potentially fooled by a good fake. Using cryptograph, ownership verification is fast and simple!

The downside is that anyone can make NFTs. 30 years ago, it took specialized equipment to make and distribute cards. You also needed permission to print cards with specific player or character images. With NFTs, anyone can make any image and call it rare.

Influencer and business guru Gary Vaynerchuck sketched out some shitty drawings of animals and now they sell for $100,000+ USD.

Some people say that NFTs are like a status symbol for the metaverse, meaning if you own an NFT, you have “clout” online. Flipping status symbols is not unheard of, such as flipping sneakers. Rare sneakers fetch some ridiculous prices, and collectors have begun preserving them in mint condition rather than wearing them, with the hope of reselling them in the future.

I suppose that’s a decent argument, since status symbols are not always logical. The question is, can you tell the difference between what’s going to be the next Bored Ape Yacht Club and what’s going to be a dud?

How To Make Money With NFTs

Minting And Selling Your Own NFTs

I am not an NFT minting expert, so I can only give you the broad overview of what’s happening during the minting process. You should refer to experts and tutorial videos for precise, step-by-step processes if you decide to mint your NFTs.

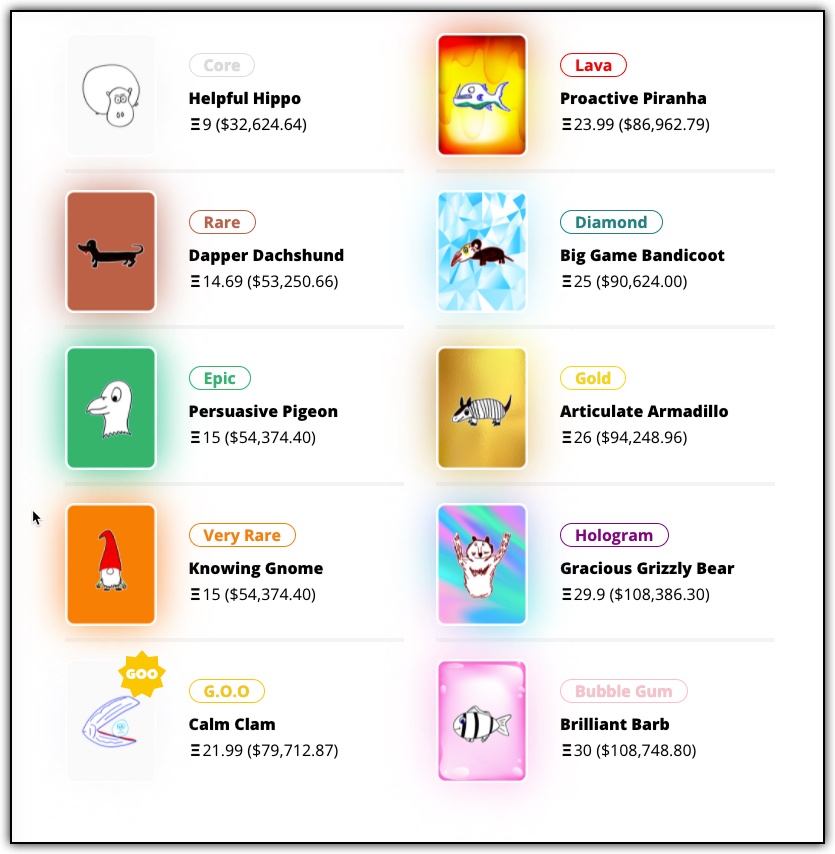

You can choose to mint an NFT of something that is one-of-a-kind, or you can choose to do a series of algorithmically altered images using “layers” in your photo editing program. This is how famous series of NFTs like Cryptopunks or Bored Ape Yacht Club were formed. You may also remember Cryptokitties, which also highlighted various hairstyles and accessories, with variations on the rarity of each feature.

In the video below, the narrow explains the entire process from start to finish, including how to find pre-generated features like eyes, hats, and accessories, as well as how to run the algorithm to automatically create 10,000 NFT variations.

The video is about an hour long, but if you’re starting with zero skills, expect to have to watch some of the more complex parts more than once, and practice before you get everything perfect. That being said, it’s pretty awesome that you can learn how to do this in an hour of instruction.

Once your NFTs are minted, you can sell them on one of the popular platforms like OpenSea or Rarible. Some NFT platforms such as Nifty Gateway or Rarible do not accept submissions from randos. Their selection of NFTs is curated, so you may have build an audience before getting a submission on their site.

How do you sell your own NFTs?

First, realize that you’ll be selling your stuff among tens of thousands of other submissions. If it takes only an hour or so to create 10,000 NFTs, then expect some competition. Where can you get your edge?

One way to get an edge is going to be by creating original, awesome art. Creating art that captures someone attention as they mindlessly scroll down the page is a sure way to find potential buyers.

You could also go the more traditional advertising route, and build a following online, then shill your project. You can build an audience by becoming part of a community and adding value to the conversation. For example, I follow some musicians online, and they have been minting some NFTs in collaboration with visual artists. I don’t know how well they sold, but it seemed like a good enough strategy.

Selling an NFT is going to be like selling anything else. You need to get your product to resonate with your audience. If your audience is digital art lovers, then you may want to create something unique and eye-catching. If your audience is people who listen your music, then your NFTs should reflect the vibe and style of your music.

Selling original NFTs as a source of reliable income is still an unproven long-term strategy. This is a brand new industry (literally only a year old), so it’s the Wild West out there. Try something and see what sticks.

Further Reading

- How To Mint An NFT (Extensive Guide)

- NFT Tutorial (Ethereum.org)

Buying, Selling, & Trading NFTs

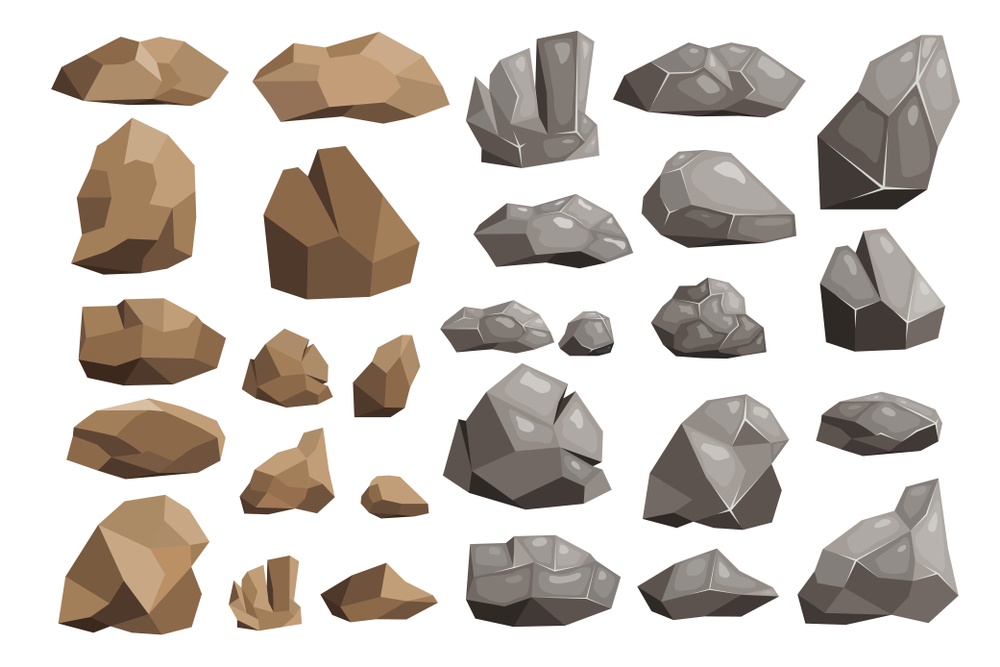

Most of the time when people want to make money selling NFTs, what they are talking about is flipping NFTs. Because of all the hype around hundred-million-dollar rocks, a lot of people think that you can just buy any NFT and flip it for 10x after a few weeks.

Of course, there’s more to the story.

Could you have guessed that images of rocks would sell for millions of dollars? Most people could not have. There’s nothing special about them except that somehow they ended up in the hype cycle and those holding the rocks profited.

To make money selling NFTs, you have to be able to pick the right project, and the right time, then sell at the peak. There’s a lot of variables to screw up.

Imagine if you are looking at a beautiful piece of painstakingly-created colorful, inspiring art. Next to it is an algorithmically created monotone, grey rock. The art costs $100. The rock costs $10,000. Which one would you buy? Most people would opt for the beautiful art, thinking that the value of NFTs is in the beauty. This is the wrong answer.

The true value of NFTs is being able to ride a price pump and dump your bags on an idiot who buys a rock for $1 million dollars.

After 6 months, the art would still be worth $100 and the rock would be worth $2 million. Who could have guessed?

Also, keep in mind that there are lots of stories of wash trading, where people basically buy and sell their own NFTs to generate hype about price. Hype can lure in n00bs to pay for them, thinking that they’ll be an easy flip, or just to generate hype around the project.

My Big Issues With NFTs As A Pleb Business

The Crypto Project Hype Cycle

My business is building websites, and when I think of starting a new website, I try to think long term. I consider what will not change in the next decade, because if I’m working my ass off to build something, I want to be able to enjoy the fruits of my labor for as long as possible. I hate jumping from project to project, looking for the next hot thing.

“I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question; it’s a very common one. I almost never get the question: ‘What’s not going to change in the next 10 years?’

Jeff Bezos

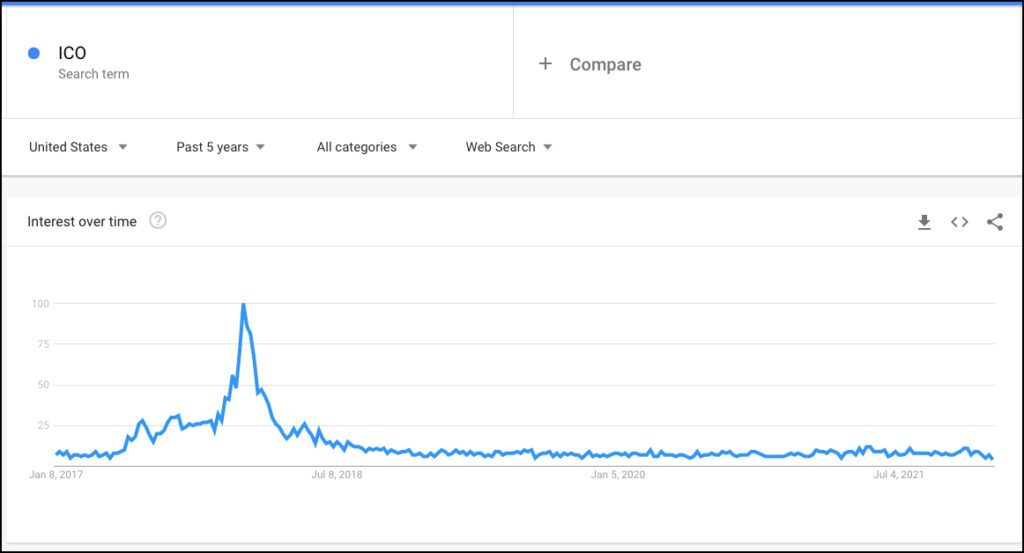

There are cycles in every industry, but the hype cycle in the crypto industry is second to none. In 2017 there was the ICO phase, which saw tens of thousands of cryptocurrency projects launched. The vast majority of them failed and never recovered their all-time-high price from that era.

Then we saw the rise of DeFi (decentralized finance), with some tokens yielding 10,000% APY or more.

For a brief moment, there was big interest in DAOs, when a group of individuals tried to buy an original copy of the US Constitution.

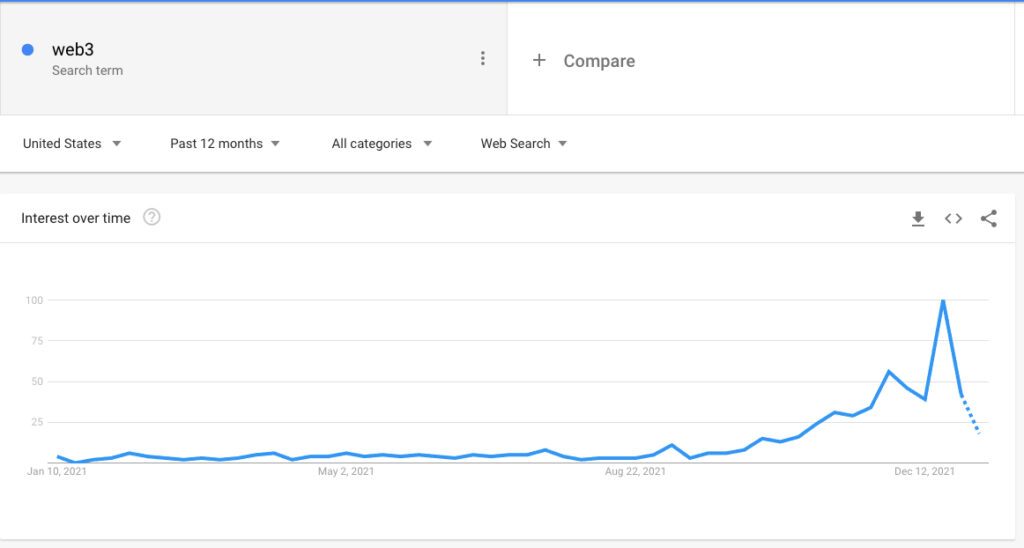

Most recently, there was a spike in interest in Web3, which seems to have died out after just a two weeks.

Long term, I think the concept of NFTs may have some value, somewhere but I don’t think the current version of “rare apes” is going to last long. I think the current iteration of NFTs is just the next hype cycle. Will you get out before the crash?

NFTs as a concept absolutely have some potential as a valuable technology. NFTs as a digital ticketing system sounds like an interesting concept. NFTs as tradeable skins or weapons in video games sounds like it could be popular (or not). NFTs as a way to issue gift cards might even be something useful.

The trouble with all of those things is that YOU can’t profit from them. If Microsoft develops the technology to create a digital gift card system that becomes widely used by Starbucks and McDonald’s, your picture of a fat penguin isn’t going to be worth more money because of it.

You could invest in L1 blockchains as a method of investing in smart contracts in general, but that still doesn’t guarantee success.

Using the Microsoft examples from above, it wouldn’t matter if you owned Solana, Cardano, or Ethereum because the real winner would be Microsoft and its proprietary enterprise blockchain technology.

Even IF there was one smart contract platform which did “win” and become the global L1 for NFTs in the future, you still have to pick which one that’ll be. How many of the L1s were around 5 years ago (Tron, Neo, Stellar), and how many will be around in 5 years? People are already complaining about high Ethereum gas fees and jumping to Solana…which had to be manually restarted at least 3 times in 2021.

Now what about Avalanche, Terra, Polygon, and BNB?

What are the chances a new L1 emerges in the future? I don’t mean to get off into the weeds here. I’m just saying that making money from NFTs is not as simple as just picking a picture you think is cool and waiting to sell it for a profit. There’s a lot going on under the hood.

Two Lessons From Bitcoin

Bitcoin is the most famous crypto asset, and in my opinion, it’s the only thing worth holding long term. Before I bought bitcoin, I asked myself, “Why does bitcoin have value?” Bitcoin has value because it exhibits the main properties of money:

- durable

- portable

- divisible

- scarce

- verifiable/recognizable

- fungible

The fungibility here is key. That means each bitcoin I trade for goods and services is just as good as any other bitcoin.

Because NFTs are “non-fungible” (it’s in the name), if you buy a dud, the only person to trade it with will be someone who sees value in that specific token. It’s not like Bitcoin, where units are fungible, and therefore can be exchanged with anyone who wants bitcoin.

It’s possible that people who like NFTs will simply not want your NFT.

Why do NFTs have value? From one perspective, since they are digital art their value comes from the aesthetic. They are nice to look at, therefore they have monetary value.

My issue here is that the aesthetic value can’t demand a monetary premium long term because I get just right-click-save the image and get the same experience as the owner. An NFTs value is not derived from the art, therefore an NFT is not digital art.

The main value of an NFT is ownership of the token, i.e. the certificate of authenticity. Therefore, NFTs are collectibles. For a peek into the future of NFTs, look at the current state of the collectibles market. There are some baseball cards or Pokémon cards that are worth a lot, but the vast majority are worth nothing. Does anybody keep a large portion of the net worth stored in collectibles? Unlikely.

Another lesson from bitcoin worth considering is the idea of decentralization and censorship resistance. Bitcoin is able to maintain its scarcity due the the fact that the ledger is distributed across the globe over 10,000 times in the form of individual-run bitcoin nodes. Bitcoin would not hold value if you could just “turn it off”, or censor transactions.

The same isn’t true of NFTs. There have been many instances of NFTs being frozen by centralized platforms. On the surface, while this looks fair and good because the original owner of the NFT was able to recover their assets, it speaks to the centralization of NFTs. What’s the point of putting an NFT on a decentralized blockchain if you can just censor transactions when it suits you?

Another problem to briefly mention is that you can actually mint NFTs of art you don’t own. You can just grab any image from the internet and create an NFT of it. So someone could potentially take your “rare image”, download it, then create a new “rare image” with a different hash. Since it’s a different hash, it’s a new token, even though it’s the same image.

Since NFTs are not fungible, not scarce, and not divisible, they fail as a store of value, and should be viewed only as a collectible.

Trading, Taxes, Holding, & Cash Flow With Collectibles

I think one of the biggest deterrents to making money with NFTs is actually making money on a consistent basis. So many stories you hear in the news are about 1-time sales of insanely priced meme art. A single BAYC or MAYC might sell for several million dollars, but that’s called a windfall, not a business.

A business buying, selling, and trading NFTs is something that you would do successfully on a consistent basis.

Even if you were lucky enough to buy an NFT that became extremely valuable in the future, a one-time windfall of a million dollars is not something you can live off for the rest of your life.

First, you’d need to pay taxes, and the taxes on collectibles in the United States is actually higher than most other forms of income at 28%, with a possible additional 3.8% on top of that. So immediately chop of 1/3 of your sales price. Then, you would need to re-invest at least some of that money into subsequent NFTs, which would also need to be successful. Rinse. Repeat.

The rinse and repeat part is the hardest. Can you successfully identify a successful NFT project over and over again to create consistent cash flow to pay a mortgage? Or are you just hoping on discovering the next million-dollar cute animal picture?

An alternative view could be that you want to hold the art for a long period of time, and cash out in 10 or 20 years in the future. Assuming that we’re still early in the NFT craze and the market will mature in the future, there a possibility that some projects with long term value could be worth tens of millions of dollars in the future.

It’s fine if you buy into that narrative (I don’t), but that’s going to require a decade or more of holding the asset. In the meantime, it’s not going to be generating cash flows. You’ll still need a job and a paycheck. You aren’t really making money from NFTs, you’re investing in them.

Is Selling NFTs Worth Your Time?

One More Cup of Coffee is not a “crypto blog”, so I look at NFTs a little differently from a typical crypto perspective. I look at NFTs through the lens of, “Can I make consistent income from this?”. In my opinion, the answer is no. Some people may get lucky a few times flipping some NFTs for short term profits, but long term, I can’t recommend it.

While I own bitcoin, I own it to store wealth, not generate it. Bitcoin is savings technology, not a business strategy.

At the end of the day, with NFTs, there will be a few winners, and A LOT of losers. Picking which one is going to be a winner is either going to require a ton of time and dedication towards becoming an expert in the space, or it’ll be a pure gamble. The next hot NFT could be a 10,000 Undead Dogs or Crypto Trees.

Even if NFTs as a whole are successful in some way, you can still end up with NFTs in your wallet that do not go up in value, or even go down in value.

If you want to become an NFT expert and have this be your side hustle or main business, then maybe if you take the time to learn the details, you can trade your way to some kind of income. The future is unknown, and it’s exciting to be involved in a brand new industry.

However, if you think you are just going to read a couple of articles online, then go mint some profitable NFTs and quit your job in the next few months to become the NFT king on Twitter, you need to rethink your strategy. That’s not how making money works, in any industry.

Nathaniell

What's up ladies and dudes! Great to finally meet you, and I hope you enjoyed this post. My name is Nathaniell and I'm the owner of One More Cup of Coffee. I started my first online business in 2010 promoting computer software and now I help newbies start their own businesses. Sign up for my #1 recommended training course and learn how to start your business for FREE!

If I Started A New Affiliate Blog Today, What Would I Do?

If I Started A New Affiliate Blog Today, What Would I Do?

Leave a Reply