I recently started buying bitcoin (who hasn’t), and had to sift through all the options of exchanges and platforms that I could choose from. I decided on Coinbase and Gemini. Both exchanges operate in a variety of countries, and are two of the most trusted exchanges to trade/buy bitcoin. I was approved instantly Coinbase, and within a few weeks by Gemini, so it was time to start buying! But can you really make money with Coinbase?

Are You Ready To Work Your Ass Off to Earn Your Lifestyle?

Are you tired of the daily grind? With a laptop and an internet connection I built a small website to generate income, and my life completely changed. Let me show you exactly how I’ve been doing it for more than 13 years.

Here what I experienced.

Getting Approved At Coinbase

If you want to make money at Coinbase, you have to get approved first. For me, this was very easy. I live in California, which is an area where they operate. Though I started relatively late to the Bitcoin craze, I wasn’t quite at the peak (The price was around $2200 when I joined, and it surged to $3000 just a few weeks later).

I had my credit card ready, plus my bank account info (routing/account number). The same day I was approved or $500 worth of credit card purchases and $5,000 worth of bank deposits. When buying Bitcoin at Coinbase, credit card and bank purchases are not equal, so keep reading to find out how much each will cost you. Plus, there’s an even cheaper option, to use their platform called GDAX. I’ll talk more about that later, because we’ll need to determine our fees to see if we’re actually making money with our trades.

*Nowadays, it may take longer to approved. I’ve read on Reddit that there’s a backlog of accounts waiting to be approved. Plus, some countries may take longer to verify to prevent fraud.

Coinbase let’s you trade Bitcoin (BTC), Litecoin (LTC), Ether (ETH), and coming in 2018 they should approve BCash (BCH).

Buy & Hold VS Trading

Before you start buying Bitcoin, you should decide on your strategy for making money. There are two basic strategies, but of course you can combine the two strategies in any way you see fit.

Buy & Hold (hodl) At Coinbase

The first way to make money at Coinbase is simply to buy and hold. It’s boring, but historically it’s always worked. Bitcoin used to be about $0.08, and now it’s almost $3,000 USD in value. Some predict that the price will rise to $500,000 or even $1,000,000 in the future. Yes. For ONE Bitcoin.

If you could secure just one Bitcoin in your wallet, it might be possible to be a millionaire in the future.

Of course, those are just wild speculations, and it could also go to $0.00 in value. But if you believe that some kind of blockchain currency will be valuable in the future, Bitcoin is in the best position to be that thing.

Considering that there may be around 10 million people with Bitcoin right now, what will happen when the other 7 billion people in the world get access to it? Remember, Bitcoin has no borders, unlike country-based fiat currency.

Technology is improving and becoming more user friendly. Just 5 years ago to safely hold Bitcoin you had to print a piece of paper with your private key and hold it offline, or at least on an ultra-secure thumb drive. Now there are specialty “hardware wallets” you can buy like Trezor, which is what I use. My dad does not understand how to buy and sell Bitcoin, but in 5-10 years, maybe he will be able to use it just like a credit card.

Plus, the younger generation is growing up comfortable with online spending. Kids graduating highschool in the next few years will be opening their own bank accounts and credit cards and looking for places to deposit money from their new jobs. All of these factors play into wider adoption of Bitcoin. Considering it’s a scarce resource (only 21 million coins), 7 billion people trying to obtain 21 million things means it will rise in value.

So buy and hold is a smart strategy for making money long term.

Sometimes Bitcoin enthusiasts will write hodl instead of hold. It’s an inside joke stemming from a typo a few years back. This humor is in the same vein as all your base are belong to us and pwned.

The main issue with buying and holding is that even though you’re making money with bitcoin, you aren’t able to spend it! The moment you spend it, you no longer own it, and then you have to buy more at a higher price.

!!! Keep reading below to find out about a special feature at Coinbase for those that allows you to hodl your coins securely, without a hardware wallet.

Trading Bitcoins At Coinbase & GDAX

Your other option is actively trading Bitcoins, Litecoins, And Ether. This strategy is a much riskier approach, and honestly I don’t recommend it.

Actively buying and selling currency is more like gambling than actually making money. Yes, some people do “win”, but most people end up losing money. Here are your choices

- Study complicated charts, math, and trading strategies for months, then take the risk to trade based on signals that are supposed to mean the price will go up or down.

- Go with your gut feeling and just try to buy low, sell high.

Digital currencies are very volatile, and there are plenty of opportunities to buy low and sell high. Even if you don’t have a strategy in mind, you will probably be right a few times. The trouble with that is that the human mind tends to remember wins more than the losses, so every trader starts to think that they have the knack for trading…until they lose big.

I fell for the same trading fallacies with regular stock trading, and fell for it again trading Ether. I noticed that every time Ether rallied, it rallied hard. I figured that every person was trying to cram into the trade to catch the wave, so I would too. The act of people believing it will go higher, would make it actually go higher.

So I bought about $1,000 USD worth of currency during a rally hoping to ride it out and earn some easy money.

Well, about 5 minutes after my trade went though, the coin dropped 10%. LOL. I bought right at the peak. It recovered afterward, and I only lost about $50 on the trade, but it spooked me enough to realize that I can never really predict which way a trend is going.

Are you just a regular person trying to make money with Bitcoin? My advice is to avoid actively trading.

Fees At Coinbase

Buying coins at Coinbase is not free. There’s a fee attached to most activities, so in order to ensure you’re actually making money, you need to calculate how much you’re paying. Here’s the full list of fees. They vary based on country.

Purchase Fees at Coinbase

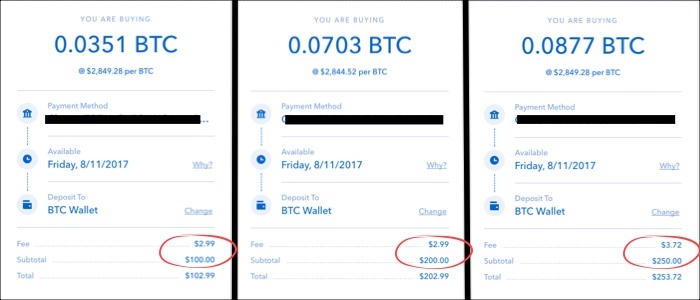

In the USA, you’ll pay a 1.49% fee on all purchases through your bank. However, I have found that if you buy less than $200, that fee remains at flat $2.99. So at $200 you are paying a 1.49% fee. At $100 you are paying a 3% fee. After $200 the fee scales properly, so at $250 you can expect to pay $3.72 or 1.49%.

If you deposit USD into your wallet, you still have to pay this fee when you buy Bitcoin. In both cases, you have to wait about a week for the transaction to confirm. So I could buy $500 USD worth of Litecoin on Monday, and not get it until Friday or later. The price is locked in, but it’s not accessible on your account yet. I can avoid this delay by depositing a chunk of USD first, then buying bitcoin with the dollars in my virtual wallet rather than buying the coins directly with the money in my bank account.

Credit Card Fees at Coinbase

Credit card fees are 3.99% across the board. So if I buy $100, I pay $3.99 in in fees. At $200 I pay $7.98. At $300 I pay $11.97. The transaction happens instantly, so I can actually get access to my coins immediately after buying.

This means that buying less than $75 worth of bitcoin at a time is cheaper if you use your credit card instead of bank.

- $100 via bank = $3 fee

- $100 via cc = $4 fee

- —–

- $50 via bank = $3 fee

- $50 via cc = $2 fee

GDAX as an Alternative

If you want to start trading and try to make money fast, then Coinbase is easy to use and understand. That’s the reason most people get started there. There’s also another feature called the Coinbase Vault, which is a great reason to use Coinbase as a service.

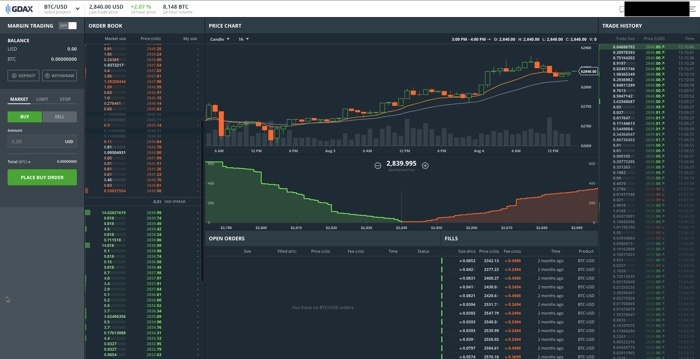

But if you’er going to buy buying cryptocurrencies frequently, especially for the reason of making money, then you need to get familiar with GDAX.

This website is actually owned by Coinbase, and there’s a lot of integration. You can move your funds back and forth between the two services freely. GDAX is like the Coinbase exchange, where you can see the prices fluctuating throughout the day as people buy and sell.

The fees are much lower here, which is why you should be buying and selling through this platform. You have to verify your bank account details separately, which could cause further delays in your ability to buy/sell, but it’s worth the wait. Here’s a list of the fees at GDAX. I think people stay away from GDAX because the are scared to trading phrases like “limit order” or “stop loss”, so they choose to go through Coinbase because it’s got a better user interface.

But when you realize that you pay 0.25% instead of 4%, it should be obvious why I recommend it.

Plus, you only pay 0.25% if you make a “market” order (immediate). If you create an order that isn’t filled immediately (limit), then you pay 0% fees.

MAKER VS. TAKER

When you place an order at the market price that gets filled immediately, you are considered a taker and will pay a fee between 0.10% and 0.25% for BTC books and 0.10% and 0.30% for ETH books.

When you place an order which is not immediately matched by an existing order, that order is placed on the order book. If another customer places an order that matches yours, you are considered the maker and your fee will be 0%.

There are no credit card options with GDAX.

Why Are Fees Important?

Consider this. If you spend $100 on Bitcoin using your bank, you’ll pay a $3 fee. Then if you sell that Bitcoin, you’ll pay another fee on top of that (1.5%). To be honest, I’m a little confused about how much this will be, considering that when I buy Bitcoin I’m paying 2.99% instead of 1.49%. I’ve never sold anything on Coinbase, so cannot confirm.

Assuming you pay another $3 fee to withdraw, that’s a total of $6 you pay.

So even if you earn 10% on your $100, the extra $10 you earned is cut by $6. You just lost 60% of your earnings to fees!

You can probably shave that down if you start dealing in $1,000’s, but I know most people don’t have that kind of cash laying around. Watch out for fees when trading!

Don’t Forget About Taxes

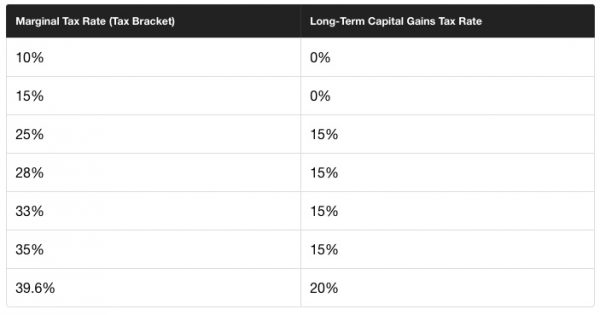

Each time you earn money trading bitcoin, that counts as buying and selling an asset, and you are taxed on whatever your earnings are. If you are trading frequently, then as a US citizen you’ll be taxed at whatever your normal income rate is. If you hold for longer than a year, you pay long terms gains. The current rate for long term gains varies, but will likely be 15% for most people.

You don’t have to pay this right away, but come April 15th, the tax man is going to remember! Cryptocurrencies are pretty much under the radar right now, but they won’t be for long. Just last month there was a report that the IRS was inquiring into Coinbase users trading histories. Be honest, and pay your taxes appropriately. Remember, every transaction on the blockchain is recorded!

So even if you make $100, you could end up paying $6 in fees, then another $14 in taxes. Plus, you still have to pay the transaction fee for transferring bitcoin to your wallet, and then another transaction fee to spend the money when you want to. Your original $100 might turn into $75 real fast!

I don’t mean to discourage you from buying Bitcoin or other cryptocurrencies. I just want to make the point that high frequency trading of any asset, is going to cost a lot in fees and taxes, and make it harder to actually earn profit, let alone reliable income.

How Much Money Have I Made Money At Coinbase?

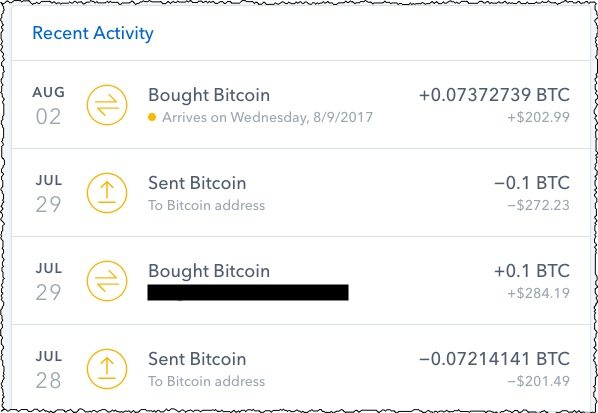

It’s important to remember that the price of cryptocurrencies fluctuate frequently, so money is not “made” until it’s in your pocket. That being said, if I’m writing about how to make money with Coinbase, I guess I’d better show my results.

I’ve made hundreds of transactions over the past few months buying Bitcoin, Litecoin, and Ethereum. I’m too lazy to download all of my transactions and make an exact calculation, but I’ll give an approximation.

- Ethereum: Lost Money

- Litecoin: Made Money

- Bitcoin: Made Money

On average, my ETH transactions happened around the $300 mark, and it’s now $220, so I’ve lost about 30% of my investment (total lost: $1500). With Litecoin, my purchases were between $24 and $49 USD, averaging around $40. At the moment, LTC is worth $43, so I’ve gained about 7% (total gained: $800). With Bitcoin, I made much larger investments, and bought around $2200. BTC is at $2800 today, so a gain of around 27% (total gain $9,000 USD).

So yes, I’ve made money. Actually, I’ve made a lot of money in a short period of time. However, it’s not that much. You can’t retire on $8000! And since Bitcoin is already so high, it’s unlikely I could repeat those results reliably.

For now, I’ll continue to keep my coins offline in my hardware wallet. I’ll update in 10 years and let you know how things are going. If a Bitcoin ends up being worth $500,000 as John McAfee predicts, I’ll be a millionaire. Wish me luck!

One More Way To Earn With Coinbase

Coinbase also has a referral program, where you can invite your friends to join and both of you will make money. If you send your link to a friend, and that friend makes $100 in transactions, both of you receive $10 worth of Bitcoin. ==> Here’s My Link

So if you join Coinbase through my link and spend $100, you earn $10 and I earn $10 each.

This helps Coinbase spread the word about their business! Because I had a good experience with them, and you probably will too, they get more customers spending money. Plus, because you are earning money and your friends are earning money, everyone is happy.

Unfortunately, it’s not a continual earning program, and you just receive the flat $10 fee. So once you run out of friends to ask to join, that’s the end of the road…unless…

Building A Cryptocurrency Blog!

One possible way to make money with Coinbase is to continually refer new people to their website. The best way to do this would be to start a website about cryptocurrency. You don’t have to be an expert – just an enthusiast. There are many strategies for how to get traffic to a website, many of which I discuss on my website here. With traffic, you can send people to your link, and get $10 each time a new person signs up.

Considering that cryptocurrency is exploding right now, you could be in a good position to make money. Just 10 people per day would be $100 per day in earnings, or $36,000 per year in earnings.

Coinbase isn’t the only company with a referral program. Other sites like LocalBitcoins, Bitbons, and Trezor all have referral programs where you can earn money.

Too new to crypto Plus, Earning money through a website is not limited to crypto though. You can pick any topic, and there will be referral programs. You can learn how to build a website, get traffic to it, and make money through referral links similar to what Coinbase is doing by starting your training here.

Nathaniell

What's up ladies and dudes! Great to finally meet you, and I hope you enjoyed this post. My name is Nathaniell and I'm the owner of One More Cup of Coffee. I started my first online business in 2010 promoting computer software and now I help newbies start their own businesses. Sign up for my #1 recommended training course and learn how to start your business for FREE!

Get Paid To Write Academic Papers

Get Paid To Write Academic Papers

iptv player

Can you take a look at this? We have a 20% paid in bitcoin affiliate program over at Torula for our alternatives to cable tv. We also have a bitcoin affiliate program that pays 20%.

Nathaniell

Sure. Sounds great!

Adam Ajet

Good stuff man. Looking at all the fees I paid on coinbase, it makes sense to trade on gdax. I actually put together a site to track my profitability on coinbase subtracting all the fees.

Samuel Jenkinson

bet youre up a lot more now, assuming youve kept at it

Nathaniell

Haha. Yeah. I sold my Ethereum to buy Bitcoin Cash, but I kept everything else. Litecoin has been a monster!

Though the debate is contentious between Bitcoin and Bitcoin Cash, I think both can survive and have their individual use cases.

Eric Diaz

Thank you for this ! Great read.