Investing in ICOs is the hottest trend this year, and people are literally becoming millionaires overnight. But can you really make money investing in ICOs or is this money-making venture just for crypto nerds and high-risk-tolerance individuals?

Investing in ICOs is the hottest trend this year, and people are literally becoming millionaires overnight. But can you really make money investing in ICOs or is this money-making venture just for crypto nerds and high-risk-tolerance individuals?

The answer will probably not surprise you, but let’s dig into some details to find out if ICO investing is something you should try.

Are You Ready To Work Your Ass Off to Earn Your Lifestyle?

Are you tired of the daily grind? With a laptop and an internet connection I built a small website to generate income, and my life completely changed. Let me show you exactly how I’ve been doing it for more than 13 years.

Making Money Investing ICOs

The first thing to talk about is the underlying idea of ICOs. How do you invest in them and why is the idea interesting?

How To Invest In CryptoCurrency & ICOs

There are a lot of variables here. Depending on the people launching the coin, which country they’re located, and where they advertise, the options for investing will vary.

Some of the bigger ICOs with good management and location will allow you to buy with fiat, which could include Paypal, credit cards, and bank accounts. However, there’s a lot of restrictions for launching a coin like this, because accepting US dollars means you’ll probably be regulated by some kind of US body, probably the SEC.

Other coin offerings that are outside the US may restrict you to investing other cryptos, namely Bitcoin and Ethereum. Especially because many of these “tokens” are built on the Ethereum network, Ether is a popular way to invest.

Beyond the practicality of how to pay for the investment, finding a good one takes hard work. There are two schools of thought.

One is that you can simply search around crypto channels like Reddit and Twitter and look for advice. If there’s a buzz around a coin and you start seeing, then it’s probably a popular and well-funded project. More money means they can pay a better team for longer, so the coin may have some longevity. That’s not always the case though! Tezos is a great example.

The other method is to find a ‘sleeper’ coin. If you do your research and find a great project that doesn’t have a lot of attention then maybe it’s because the team is busy working instead of promoting.

Projects like Monero are good examples of grassroots promotion. Although they generally take longer to see good returns, the legitimacy of the project means those gains are locked in, instead of pumped and dumped. Monero is a solid cryptocurrency which launched at less than $1 per coin just a couple of years ago and is now almost $400.

The Pros of ICO Investing

The main obvious advantage to investing in ICOs is that you can make a lot of money fast. It’s a legitimate way to get rich quick. By “legitimate”, I mean that you aren’t scamming anyone or doing anything that’s against the law. An investment of just $1,000 could turn int0 $10,000 overnight, or $100,000 in just a few months or years.

Many people will tell you that the train has left the station, and if you haven’t gotten rich off of cryptocurrency yet, you never will. This is far from the truth.

Though no one can predict which way the market will move, long term, cryptocurrency is here to stay. Just this week Ripple, one of the largest cryptocurrencies by market cap tripled. My investment of $1,000 USD in October 2017 is now worth almost $9,000 USD as of December 29.

If I had invested that same dollar amount 12 months earlier, it would probably be worth a few hundred thousand dollars. I didn’t have the foresight to do that, but this is where ICOs come in. If you can pick the correct coin, right at launch, and invest a decent portion of money into it, you could make some serious bank in the next couple of years.

Even as a trader just riding the waves of pump and dumps, you could probably make some quick gains.

Of course, you’d have to pick the right coin! That’s why many people will own a “basket” of cryptocurrencies. If you invest $1,000 in 10 ICOs, and 9/10 go bankrupt but one skyrocket, you’ll lose $9,000 dollars but potentially gain much more.

It’s also just an exciting and interesting industry to be introduced to. Personally, I think cryptocurrency is like Pokémon for adults. LOL. Each one has its own story, its own use case, history, future potential, and position in a diverse investment portfolio.

I love sitting on Reddit, Twitter, Slack, GitHub, or Bitcoin Talk reading what people have to say. All these new YouTube channels with people talking about their thoughts on a specific crypto coin are very interesting. As a hobby, I think it’s a great way to exercise your brain, and probably more useful than watching The Bachelor on TV!

In short, investing in ICOs is an interesting hobby that you could get rich from. What’s not to like?!

The Cons of ICO Investing

It’s not all sunshine and dollar signs in the world of ICO investing! There are plenty of downsides to discuss before you start wiring your life savings to a cryptocurrency exchange.

The #1 downside is that this is pretty much the riskiest thing you can do with your money. A lot of people have lost a lot of money already, and more people will continue to lose money in the coming years.

For all the crypto millionaires out there that sold their coins and now have actual dollars they can spend, there were just as many people on the other side of that transaction that are still holding the coins at value, or at a lesser value. Remember, someone has to buy your ICO coin for you to make actual money with it!

That’s a great introduction my biggest issue with investing in ICOs: Liquidity

Many times, when you buy coins at an initial coin offering, they are simply locked away and you can’t do anything with them. They are for use at a later date. You are essentially giving company money so they can develop the project, and you are hoping that they will, at some point, give you the coins you ordered and that those coins will be worth more money than you paid, or will gain in value over time. It’s kind of like investing in a Kickstarter or Seed Invest project.

Like Seed Invest, if you are confident in the project, then waiting isn’t a big deal. But if you have weak hands and want to sell your coins in a week for rent, or trade them for a more promising project, then you are out of luck.

Even if the coins get listed on an exchange, it might be only one, and it might not operate in your country. Many exchanges don’t allow US citizens to join because it means they have to comply with the US investing regulatory bodies.

The most popular exchange in the US, Coinbase, only has four coins listed right now: Bitcoin, Litecoin, Bitcoin Cash, and Ethereum. Gemini only has Bitcoin and Ethereum. Kraken has more trading pairs, but they certainly won’t list your brand new token!

Plus, there’s no guarantee that the exchange listing the coin will the trading pairs you want. In an exchange like Poloniex, which has a lot of cryptos available, you won’t be able to sell your tokens for dollars or other fiat currency.

You’ll have to trade for Bitcoin, then deposit that bitcoin into another exchange, then withdraw from there. With Bitcoin fees so high right now, the trade from token > bitcoin, then bitcoin exchange 1 > bitcoin exchange 2, then bitcoin > fiat, you could be paying hundreds, if not thousands of dollars in fees just to get your money back.

If you just made a hundred grand in US dollars, then paying a thousand in fees doesn’t matter. If you just lost 50% of your investment and want to cash out, then $200 in fees could take your losses even further into the red.

You might be saying, “What about the risk of losing your money? Isn’t that the biggest problem with buying into ICOs?”. Yes, that’s a huge risk too. But it’s too obvious.

I’m assuming that if you are ready to put your money into a project that you have done good enough research to make yourself feel confident in purchasing the currency. But in case you haven’t already seen the million other warnings out there, yes, there’s a chance that the money you invest could be worth nothing in a very short period of time.

What about storage? This is another potential problem to consider. Just 5 years ago MtGox was hacked and people lost millions of dollars in Bitcoin. Recently, YouBit was hacked and shut down. Most of these ICOs will not function with the Trezor or Ledger* hardware wallets.

Most won’t even have dedicated software wallets. As a result, out of convenience, you’ll probably store your coins on an exchange, which puts your money at risk! (*If you’re investing in an ERC-20 token on the Ethereum network then you can store your tokens on your Ledger Nano S through My Ether Wallet.

“Stock picking” and “marketing timing” two more issues you need to consider. In other words, you have to be really good at guessing to actually make money. There’s thousands of ICOs launching next year…can you find the right one? What if you find a good one, but a scammy one has better marketing?

The scam might skyrocket while your quality project languishes for a couple of years until they prove themselves. Very often, the most exciting projects are the ones with unreasonable goals!

On top of that, you need to know when to sell, if you want to sell at all. Prices could surge 800% in a day, then drop 700% over the next six months. Your investment could go all the way to the moon and back. At what point will you sell? What if you sell after 300% gains and then it continues to return 2000% on top of that?

A famous example is that Isaac Newton made a bunch of money in the South Sea Company, cashed out, then, upon seeing the stock price continue to gain, re-invested. Eventually, the company went bankrupt, and he lost all his original gains. This could happen to you too since FOMO (fear of missing out) is something inside all of us.

One last risk to consider is that when buying into an ICO, you are essentially buying based on faith. This is not an IPO.

At least with an IPO, you have the advantage of looking at the history of a company to decide if you like their product. The CEO and product creator probably have an online history you can research, and then decide if you trust them at the helm. There are actual numbers you can look into like how many customers vs operating margin, and you can justify a stock price.

With an ICO, you’re just listening to a couple of promotional videos, reading the white paper explaining what they hope to do, and then trusting that the whole system will work. We simply don’t have enough information to make “educated” guesses on which ICOs will work out.

An interesting use case for a token isn’t a guarantee the coin will succeed….even if dev is great…even if they have a fantastic work ethic…even if they have a bunch of money to see the project through.

Should You Buy Into An ICO? Which One?

OK, so you’re comfortable with high risk, high rewards. You’re prepared to invest only the money you can stand to lose. Which ICO should you invest in?

I really wish I had some advice here! Personally, I haven’t invested in any ICOs myself, and don’t have any serious plans to do so in the future. I’m kind of interested in the Polymath ICO, but they haven’t even released the white paper yet. It also seems like a very popular one, so it might be pricey to get into.

My interest lies mainly with the bit cryptos like Bitcoin, Litecoin, Ripple, Monero, and Bitcoin Cash. I have my eye on a few other smaller coins like Spectre, Pivx, and SiaCoin, but haven’t bought yet. It’s seriously hard to buy some of these without access to overseas exchanges.

Some block US citizens, and others have simply closed their doors to new members due to the large influx of interest. They can’t handle all the popularity! Even services like ShapeShift have delisted or don’t have many of these coins due to a lack of liquidity! I can get a couple on Kraken, but can’t get my tier 3 verification and they won’t answer emails because they’re too busy.

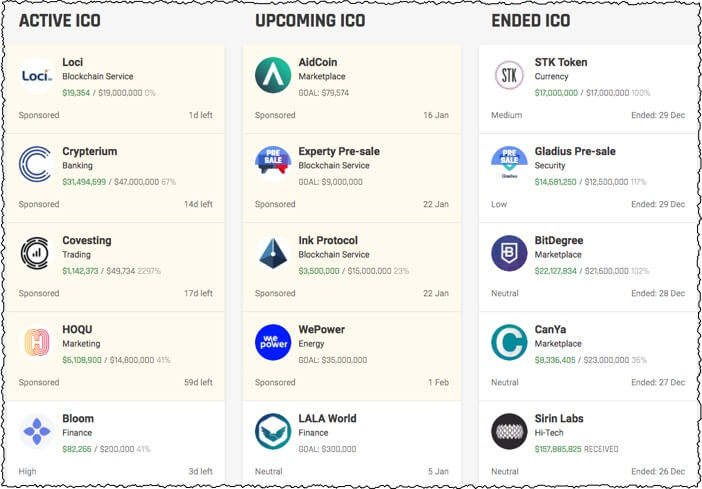

See?! I’m trying to give people money for coins, and it’s not as easy as it sounds LOL. Here’s a list of upcoming initial coin offerings to investigate.

Alternatives With Less Risk

As mentioned above, I haven’t really gotten into the ICO game due to liquidity issues. I don’t trust exchanges to hold my money for security reasons, and I doubly don’t trust them to actually function while coins are pumping or dumping. Exchanges crashing during high trading volumes are very common.

That doesn’t mean my investment portfolio is limited to US bonds making 2% per year! Like I said earlier, I do have some cryptocurrency. Personally, I own cryptos that allow for easy cold storage and are highly liquid. Those are my two main “hard” data points.

I want to be able to store it safely and exchange or sell it at any time. I do give up some of those juicy 500% per day gains, but I still do pretty well. Ripple is up about 800% since I bought it in October. Monero went from $40 to $400 in the last couple of months. Bitcoin, the cryptocurrency with the largest market cap by far has also increased 10-fold since May 2017.

Of course, those gains aren’t locked in, but I’m just saying that you don’t have to spend a ton of time or put unnecessary risk on your investment portfolio to make good crypto gains. That doesn’t mean I’m not looking at ICOs though! Once you make 100% gains in a day, the adrenaline wears off and you start looking for even bigger rewards. That’s just human nature.

If you are new to cryptocurrency and ICO investing, I’d stick with the top 25 coins and pick a couple of projects you believe in. There’s way more information out there to research, and years worth of discussion to sort through to help you make the decision to invest. With more resources available to you, it’s easier to make educated investing choices!

What do you think? Are there any ICOs you’re looking forward to? Leave a note in the comments!

Make Money Investing in ICOs

Newbie Friendly

Cheap To Start

Easy To Scale

Income Potential

Final Review

There are thousands of different side hustles you could do to earn some extra money on the side, and which one "clicks" for you depends on your personality and goals. However, there's one side hustle that makes an insane amount of money and works for anyone.

Starting an affiliate website is an incredible way to earn extra money because you can do it from your home on a laptop, and work on your business in the evenings and on weekends. The income potential is huge, and it's easy to scale

Nathaniell

What's up ladies and dudes! Great to finally meet you, and I hope you enjoyed this post. My name is Nathaniell and I'm the owner of One More Cup of Coffee. I started my first online business in 2010 promoting computer software and now I help newbies start their own businesses. Sign up for my #1 recommended training course and learn how to start your business for FREE!

How Much Money Can You Make Freelance Writing?

How Much Money Can You Make Freelance Writing?

Leave a Reply