For many years, I was in the camp of “don’t mine bitcoin at home” because it’s too complicated and you can just buy it on something like CashApp quickly and cheaply. Then I actually learned about bitcoin, and why it’s an important invention, and now I’m very much in the camp of, “some people will benefit from mining bitcoin at home”.

Are You Ready To Work Your Ass Off to Earn Your Lifestyle?

Are you tired of the daily grind? With a laptop and an internet connection I built a small website to generate income, and my life completely changed. Let me show you exactly how I’ve been doing it for more than 13 years.

The truth is, making money mining bitcoin requires some equipment and some interest, but it’s not rocket science. More importantly, the resources around how to mine bitcoin for yourself have exploded in 2020 and 2021, and I suspect that they will only get better in subsequent years. Already, there are people tinkering away in their basement with advanced technology like immersion-cooled mining or even heating their home with excess miner heat. Even Block (formerly Square) has announced that they are working on retail-focused, modular mining technology, though we may not see the results of that research for a couple years.

PLUS, right now, as of 2022, the dynamics for being a profitable bitcoin miner have never been better.

The bitcoin mining ban in China and supply chain constraints means that there are a lot of decently priced miners on the market and big companies are struggling to add miners to their operations because there simply isn’t rack space available. It takes time to set up industrial electrical facilities, including substations, warehouses, and the actual metal racks on which the bitcoin miners sit.

This is a great time to take advantage of market dynamics and make some money as a solo bitcoin miner.

Bitcoin is sitting at a price of $40,000 USD, and if you have cheap electricity with a newer miner, it can cost you less than $10,000 to mine a bitcoin. Of course, there are lots of variables to consider, and that doesn’t count the capital investment of purchasing a miner (an S19 could cost about $10k-$20k alone) but broadly speaking, it’s very cheap to mine bitcoin compared to the price of purchasing it outright.

Even if you don’t go with the at-home miner solution, there are a couple different ways to mine bitcoin for profit as an individual, and not all of them involve actually owning a physical bitcoin miner at your house. If you’re interested in making money mining bitcoin, here are 3 ways to do it.

3 Ways To Mine Bitcoin For Profit

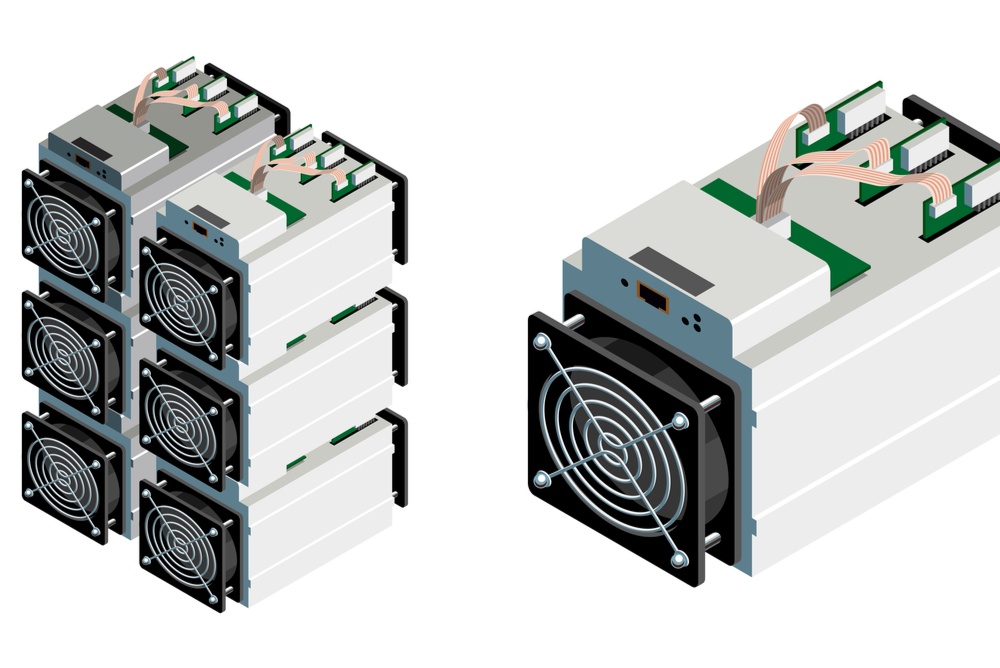

1. Mine Bitcoin At Home

You don’t need an industrial mining farm to make money mining bitcoin. As a solo miner, you can be profitable simply by contributing your hashrate to the bitcoin network. Though it’s not very common, it’s possible that you could randomly mine a whole bitcoin by yourself, meaning a single home miner could reward you with ₿6.25, which is currently valued at over $250,000!

Of course, that doesn’t happen often. In fact, there’s a 1 in 100,000 chance that you could do this, and how those miners were able to collect their ₿6.25 reward required some special conditions which are not worth going over here (linked above). Most people participate in bitcoin mining via “pools” which reward them a cut of the block reward based on their hash rate – how much power their bitcoin miner projects (hashing power of the unit x electricity expenditure).

Basically, more energy use = more bitcoin rewards for the miner.

Using that formula, you can optimize your operations. If you can find cheap energy, that means your energy expenditure will cost you less money, so your profit (bitcoin reward – cost to mine) is larger. If you invest in a more powerful miner you can hash at a higher rate, but it’ll cost more money in electricity and the miner will be more expensive.

Tweaking your costs versus reward ratio will determine how much money you make mining bitcoin at home.

Two best and most complete written guide to get started is Home Mining For Non-KYC Bitcoin, but there are tons of additional resources out there. I’ve found that podcasts are extremely helpful, and they can be a good way to source out more personal avenues for help like Telegram, Sphinx, Discord, and good Twitter profiles to follow. Unfortunately, YouTube is a cesspool of garbage information and scams. The only good info I found was when you typed in specific info like “Antminer S19 Pro Review”.

The home mining community is really tight, and there’s lots of experimentation going on with immersion cooling, using excess heat to heat a pool or home, and I’ve even seen some solar and wind-powered bitcoin mining experiments.

Recently, a modular oil & gas mining company Upstream Data even started selling something they call The Black Box, which is an all-weather, outdoor miner, specially designed to cut back on ASIC noise. Just pop in two ASICs, drop it outside your house, and you’re mining bitcoin without all the heat and noise!

Funny Update

As a side bit of funny news, a new solo miner just mined a block through CKPool using a ridiculous USB mining farm, which is something I never would have imagined happening.

2. Mine Bitcoin With Hosted Mining

Mining bitcoin at home does come with the difficulties dealing with heat and noise from the ASIC, plus you do have to do some configuration to get your miner connected to a pool. You may also have to deal with a broken rig from time to time, and it’s not like you can take it to the local computer shop to get repaired. ASIC downtime costs you money, plus the cost of repair.

For many, bitcoin mining at home is a labor of love, not necessarily an insanely profitable activity. Of course this is always changing, but if you want to get the rewards of mining without actually dealing with the mining equipment yourself, you can opt for hosted bitcoin mining.

Probably the biggest and best company doing this right now is Compass Mining. What they do is pretty awesome.

You buy mining rig from them, then they place it in one of their hosted facilities. They do all the leg work to make sure that the facility is quality, and they negotiate better electricity rates. This means it would be a good option for someone living in an area with expensive electricity. For example, you could be living in $0.16 kwh California, but be paying $0.05 kwh in Russia to mine bitcoin. Electricity arbitrage!

They run various promotions from time to time as well. For a while, you were able to pre-purchase miners at a specified cost, which ended up being a good deal because miners were in demand, so you locked in cheap rates to buy rigs over the course of 12 months. As I write this, they are offering payment plans for miners, which can be useful if you don’t have the $10k+ to front for a ASIC right now.

Another company that offers hosted mining is River Financial. I’m less familiar with the mining offer from this company, and they are currently only accepting applications to get on their wait list. River is one one of the top bitcoin-only exchanges, and the cool thing about River is that you are able to purchase a miner and have the bitcoin you mine go directly into your River account. You can then sell your bitcoin for for fiat cash, or withdraw to your own private key set.

Buying hosted miners is great because it’s a very hands-off process for non-technical people who want to experience the daily income of mining bitcoin, but aren’t ready to get their hands dirty, or simply don’t have the option to put a physical miner in their home.

There are definitely some downsides to hosted mining though, mainly that you don’t control a lot of what’s going on behind the scenes. Where’s the miner coming from? What condition is it in? What’s going on at the hosted facility? Etc.

Compass has been in hot water lately (Q4 2021) because they promised some dates to go live with some miners which didn’t pan out. If you buy a miner with a launch date that’s 6 months in the future, and 9 months later you’re still not live, all you will see every day is lost revenue, and you’ll be asking yourself, “Why didn’t I just buy bitcoin?!”

This is what happens as you remove yourself from the process though – you lose control. The advantage is you have less responsibility, but the disadvantage is that you rely on someone else to do the work for you, and your profitability depends on their performance.

Another issue with hosted mining in general, is that considering the hashrate of the bitcoin mining network seems to be continually going up, it’s going to only get more difficult to mine bitcoin over time. Thanks to the genius addition of the difficulty adjustment, when more miners compete for the block reward, it becomes harder to mine blocks.

That means the miner you buy today will likely become less and less profitable over time. Considering how fast-paced this industry is moving, if your hosted miner isn’t going online to a facility for another half a year or more, it could seriously change your investment thesis

3. Buy Bitcoin Mining Stocks

The fastest way to profit from bitcoin mining is to own no miners at all, and to just buy bitcoin mining stocks. You can hop onto your brokerage account and buy shares of a large, North American bitcoin miner like Riot, Marathon, or Bitfarms (disclosure: I own $RIOT and $BITF). There are more out there, and more going public.

Bitcoin mining stocks have become a popular way to supercharge returns, even when compared to bitcoin’s parabolic rise in price. As bitcoin goes up, these stocks typically outperform bitcoin. As they go down, they get crushed even harder. This is probably due to a number of factors, including the fact that they mine bitcoin for cheap, hold bitcoin on their balance sheet, and are a way for larger institutions or retail investors to get bitcoin exposure in their portfolios, without actually owning bitcoin.

The advantage here is that although you’re making money from mining bitcoin, you don’t actually need to do anything other than click a button to buy the stock. No wait time. No shipping. No maintenance. No down time. No technical knowledge needed.

The downsides are obvious.

For one, you have zero control over the mining operation. You’re also exposed to company risk, including political risk. If your mining company is located in an area that decides to ban bitcoin mining, you’re screwed. If the CEO decides to start mining some garbage coin on the side and it tanks in price, the stock could move the opposite way of bitcoin. There are any number of things that could happen to this company which are completely unrelated to bitcoin.

The long term sustainability of pure bitcoin mining companies is still an unknown. Many companies in the past have simply gone bankrupt due to mismanagement.

More importantly, however, is that although you own shares in a bitcoin mining stock, you don’t own any bitcoin. Bitcoin is an incredible form of money. It’s strictly limited to the number of units available, and can perform final settlement to anybody in the world in less than an hour. If you “get” bitcoin, then you know you need to own some, and you need to own your own keys.

When you own a bitcoin mining stock, you might see your fiat balance grow in purchasing power, but you’re not mining bitcoin, and you don’t own bitcoin.

3 Awesome Benefits Of Mining Bitcoin At Home

1. Non-KYC Sats

The most important benefit of mining bitcoin at home is that you get access to non-KYC sats. This means you get clean, fresh bitcoin that cannot be linked to your physical identity. This is unlike bitcoin you’d typically buy from a KYC exchange, which can be easily connected to your identify from withdrawal addresses linked to the private information you must submit to bitcoin exchanges.

Non-KYC sats are the most private way to use bitcoin, since on-chain analytics companies will not be able to link these bitcoin to your previous bitcoin transactions (assuming you use bitcoin in a private way after you acquire them).

Being able to use money in a private way is not a new idea. Every time you use paper cash, the cashier at the store doesn’t know your name, you social security number, or which store you visited previously. It’s a one-time transaction, where your identity doesn’t matter. You have money, they have a good, and the exchange is voluntary.

Contrast that to using a credit card or a digital wallet where the bank knows your identity and can track every single transaction you did since the the beginning of your banking relationship.

This can be done with Bitcoin as well. If you buy your bitcoin from an exchange, those bitcoin are linked to your identity, and exchanges can then sell your data to analytics companies who track the bitcoin over time. Plus, if exchanges are not responsible with that data, it could be used by hackers or other criminals.

Using bitcoin privately is definitely a process, so it’s not for everyone, but if you like tinkering, are technically minded, and care about online privacy, then collecting non-KYC sats via at-home bitcoin mining is definitely worth it. This is why some people mine bitcoin at home even if their expenses exceed the revenue (1 BTC still equals 1 BTC).

2. Add More Hashrate & Network Security

If you own some bitcoin, will start to care about the Bitcoin network. If Bitcoin succeeds, it’s likely that the price of bitcoin will go up, and you’ll be more wealthy because of it. Bitcoin hash rate is directly related to network security, and the higher the hashrate, the more secure the network is from block reorganization from a 51% attack.

The more people and companies that mine bitcoin, the stronger Bitcoin network security becomes. To perform a 51% attack, an attacker must control at least 51% of the network hash. That means they’d need to acquire as many miners and enough electricity to outcompete more than half of all bitcoin miners in existence.

The higher the total hash rate, the more miners and electricity they would need. The more distributed the hash, the less of a chance of large entities colluding and consolidating as an attack vector.

Like running a node, it’s not “necessary” to mine bitcoin to be part of the network. Buying and holding bitcoin is also participating. However, contributing just one miner to the overall bitcoin network can be a simliar experience, as you realize that your individual, tiny effort is making a difference to the whole.

3. Learn More About Bitcoin

Once you learn what bitcoin is and why it’s an important technology, it’s hard to unsee it. That’s why so many people are crazy about bitcoin. Bitcoin is very cool!

Bitcoin mining is just one more rabbit hole to go down. The more you learn about bitcoin, the more you want to learn about it. Each person who gets into bitcoin takes a different angle and ends up specializing in some kind of area. Some people really like the “alternative asset” angle. Some people go hard on the “personal sovereignty” thing. Others stick with the tech and look at how to make bitcoin better for the future.

Who knows – you might be the bitcoin mining person!

When you start to mine bitcoin at home, you’ll need to learn some new things, and along the way, you’ll also learn more about how bitcoin works. It’s a challenge, but it’s fun!

Nathaniell

What's up ladies and dudes! Great to finally meet you, and I hope you enjoyed this post. My name is Nathaniell and I'm the owner of One More Cup of Coffee. I started my first online business in 2010 promoting computer software and now I help newbies start their own businesses. Sign up for my #1 recommended training course and learn how to start your business for FREE!

How To Make Money With Bored Ape Yacht Club NFTs

How To Make Money With Bored Ape Yacht Club NFTs

Leave a Reply